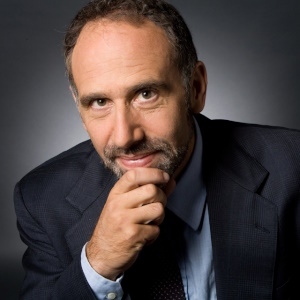

Nouriel Roubini Speaker Biography

Economics Expert Who Predicted Global Financial Crisis, Professor Emeritis of Economics, NYU’s Stern School of Business, Consultant, and Fund Co-Founder

Nouriel Roubini is the Chairman & CEO of Roubini Macro Associates, LLC, a global macroeconomic consultancy firm in New York. He is also Senior Advisor to Hudson Bay Capital, a hedge fund based in New York and serves as the Chief Economist & Portfolio Manager at Atlas Capital Team L.P, a fintech ecosystem developed to serve as a source of stability for the challenging times ahead. He has been Professor of Economics (1995-2021) and is now Professor Emeritus (2021-present), at New York University’s Stern School of Business.

Global Economist

Previously, he served as the Senior Economist for International Affairs in the White House’s Council of Economic Advisers and has worked for the International Monetary Fund, the US Federal Reserve, The World Bank and was on the faculty of Yale University’s Department of Economics.

Media & Publications

Dr. Roubini’s views on global economic issues are widely sought and cited by the media, having recognized ahead of others the 2008 global financial crisis, the effects of which reverberated around the world lasting well into the next decade. He is a frequent commentator on various business news programs and has been the subject of extended profiles in many leading current-affairs publications including the New York Times Magazine & The Financial Times. He is published monthly as a columnist with Project Syndicate. He also co-runs the site www.theboombust.com, an economic indicator research service.

Books

His most recent book, published in October 2022, is “Megathreats: Ten Dangerous Trends That Imperil Our Future and How to Survive Them” (Little Brown). He has also published numerous theoretical, empirical and policy papers on international macroeconomic issues and coauthored the books “Political Cycles: Theory and Evidence” (MIT Press, 1997) and “Bailouts or Bail-ins? Responding to Financial Crises in Emerging Markets” (Institute for International Economics, 2004) and “Crisis Economics: A Crash Course in the Future of Finance” (Penguin Press, 2010).

Education

Dr. Roubini received an undergraduate degree at Bocconi University in Milan, Italy, and a doctorate in economics at Harvard University. Prior to joining Stern, he was on the faculty of Yale University’s department of economics.

Nouriel Roubini Speaking Topics

IMPENDING RECESSION—A Stagflationary Debt Crisis Looms

Inflation is more persistent than transitory; it is driven more by stagfationary negative supply shocks than excessive aggregate demand; central banks trying to normalize policy rates risk causing a hard landing rather than a soft landing; when faced with the risk of a hard landing central banks may decide to blink and not tighten enough, thus causing a permanent rise in inflation; a recession/hard landing will not be shallow and short lived; it will rather be long and painful as there are severe financial imbalances and excessive private and public debt; US and global equity markets will continue to fall more as a hard landing - even a short one - is associated with falls of over 35%.

Globalization, Technology and Their Discontents

There recently has been a populist backlash against globalization in its many manifestations: free trade, migration, technological innovation and supra-national governance. This backlash is also associated with the rise in income and wealth inequality and the concerns that large parts of populations have seen their jobs and incomes threatened by the various elements of globalization. At the same time robotics, AI and automation may over time threaten lower skilled blue collar workers, as well as white collar jobs and wages even more than trade and migration. How severe is this backlash and its political manifestations in the form of the rise of populist leaders? Are protectionism, trade wars and sharp restrictions to migration the new norm or can globalization be improved and saved? Is the future of AI utopian or dystopian for workers? What are the appropriate policy responses to make sure globalization benefits most - rather than a few? Roubini provides a roadmap and answers to these questions.

Key Economic Challenges of Our Times

While the short-term outlook for advanced economies and emerging markets is mixed, there are longer term economic challenges that most countries face. Potential growth and productivity growth are low in spite of new industries of the future and innovation while structural reforms to boost growth are politically challenging. Private and public debts are a burden on growth, but appropriate productive fiscal policies such infrastructure spending, can boost both the supply and demand side of growth. Unconventional monetary policies are still the norm in most advanced economies, maybe necessary but with side effects. Globalization and technological innovation have benefited the world but also disrupted jobs, firms, sectors and entire economies as there are winners and losers within and across countries; thus, the populist backlash against it. Demographic changes and more healthy longevity provide opportunities but also fiscal risks - given unfunded health care and pension schemes. Roubini argues that we live in a world of change, risks, disruptions and uncertainties that need to be managed properly to ensure global economic prosperity and financial stability.

Upsides and Downsides in the Global Economy and Financial Markets

The outlook for the global economy and financial markets is mixed. The positives and upside include a pick-up in global growth after years of a new mediocre, profitable corporate firms, better business and consumer confidence, more optimistic investors with markets in risk-on mode, the rise of emerging markets, new technologies and innovation. The downside, however, are several: uncertainties about Trumponomics, the risks of European and Eurozone dis-integration, the potential for a hard landing of highly indebted China, the sluggish global growth and productivity in a world of high private and public debts, the frothiness in financial markets and the risks of assets and credit bubbles fed by easy monetary policies, the backlash against globalization and geopolitical risks. Markets are now bullish, but the economies are still sluggish. Roubini argues that a new policy framework is needed to minimize the downsides and maximize the upsides.

Nouriel Roubini Books

MegaThreats: Ten Dangerous Trends That Imperil Our Future, And How to Survive Them

Purchase Book

Crisis Economics: A Crash Course In The Future Of Finance

Purchase Book

Bailouts or Bail-ins? Responding to Financial Crises in Emerging Economies

Purchase BookNouriel Roubini Videos

Nouriel Roubini Articles

Nouriel Roubini Speaker Testimonials

Let me thank you for your brilliant job and cooperation while preparing for our event. We were extremely glad to get Mr. Roubini as a speaker for the Russia Forum 2009 and we hope that he also enjoyed the event and his stay in Moscow. His speech was met with great enthusiasm and interest.

- | The Russia Forum 2009